All Categories

Featured

Consider Making use of the cent formula: cent means Debt, Income, Home Mortgage, and Education and learning. Total your financial obligations, home mortgage, and college costs, plus your income for the variety of years your family requires defense (e.g., till the kids are out of your house), and that's your protection requirement. Some monetary professionals calculate the amount you need making use of the Human Life Worth approach, which is your lifetime earnings possible what you're earning currently, and what you expect to gain in the future.

One means to do that is to look for business with strong Financial stamina ratings. face value of term life insurance. 8A business that finances its very own plans: Some firms can market plans from one more insurer, and this can include an additional layer if you intend to transform your plan or in the future when your family needs a payout

The Combination Of Whole Life And Blank Term Insurance Is Referred To As Family Income Policy

Some business offer this on a year-to-year basis and while you can anticipate your prices to climb substantially, it may be worth it for your survivors. One more way to contrast insurance policy firms is by looking at on the internet customer testimonials. While these aren't likely to inform you much concerning a firm's monetary stability, it can tell you how easy they are to collaborate with, and whether cases servicing is a problem.

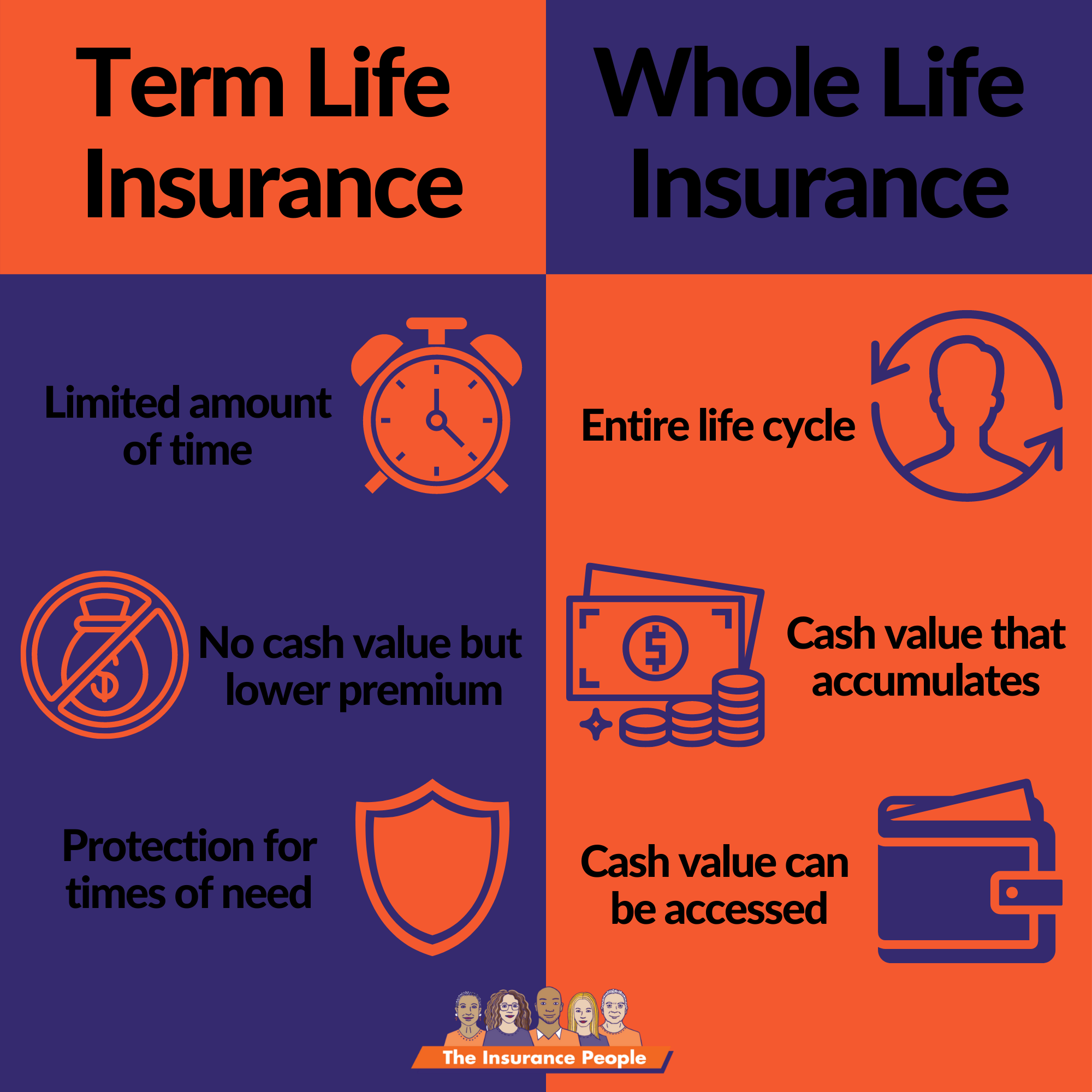

When you're more youthful, term life insurance policy can be an easy method to secure your enjoyed ones. However as life changes your financial concerns can also, so you may intend to have whole life insurance coverage for its life time coverage and added advantages that you can make use of while you're living. That's where a term conversion can be found in - renewable term life insurance policy can be renewed.

Authorization is guaranteed despite your health. The premiums won't raise as soon as they're established, yet they will increase with age, so it's an excellent concept to secure them in early. Discover even more concerning exactly how a term conversion works.

1Term life insurance provides short-term defense for an important duration of time and is typically less costly than long-term life insurance policy. the combination of whole life and term insurance is referred to as a family income policy. 2Term conversion guidelines and constraints, such as timing, may apply; for example, there may be a ten-year conversion advantage for some items and a five-year conversion advantage for others

3Rider Insured's Paid-Up Insurance Acquisition Choice in New York. 4Not readily available in every state. There is an expense to exercise this cyclist. Products and bikers are readily available in approved territories and names and attributes might differ. 5Dividends are not guaranteed. Not all taking part plan proprietors are qualified for dividends. For pick riders, the condition relates to the insured.

Latest Posts

Free Burial Insurance For Seniors

Single Premium Term Life Insurance

Insurance For Cremation