All Categories

Featured

Table of Contents

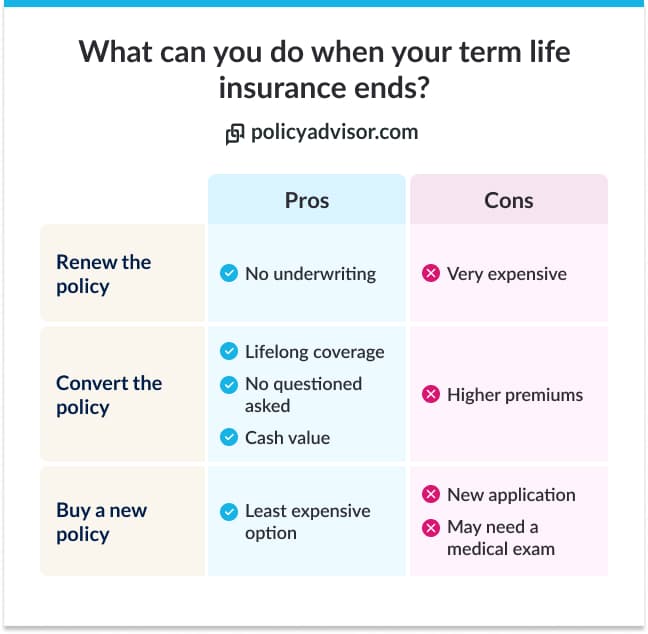

There is no payment if the policy runs out prior to your death or you live past the plan term. You might be able to restore a term policy at expiration, but the premiums will be recalculated based on your age at the time of revival.

At age 50, the costs would certainly rise to $67 a month. Term Life Insurance policy Fees 30 years old $18 $15 40 years old $28 $23 50 years old $67 $51 Resource: Quotacy. Quotes are for a $250,000 30-year term life plan, for men and women in excellent health and wellness.

Can You Get Term Life Insurance If You Have Cancer

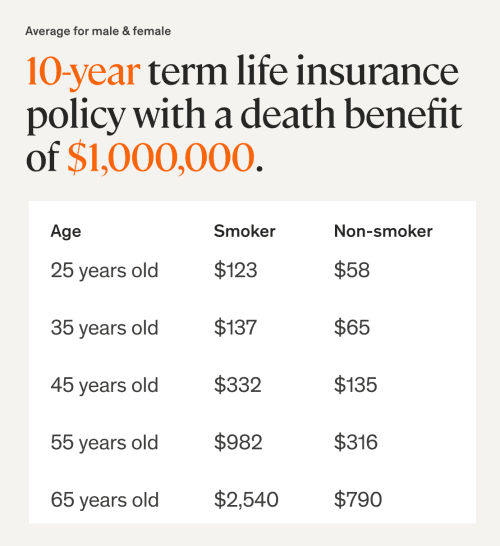

Interest prices, the financials of the insurance coverage business, and state policies can also impact premiums. When you think about the amount of coverage you can get for your premium bucks, term life insurance often tends to be the least pricey life insurance policy.

Thirty-year-old George wishes to protect his family members in the not likely occasion of his very early death. He buys a 10-year, $500,000 term life insurance coverage policy with a costs of $50 each month. If George dies within the 10-year term, the plan will certainly pay George's recipient $500,000. If he passes away after the plan has actually ended, his recipient will certainly obtain no advantage.

If George is detected with an incurable ailment during the very first policy term, he most likely will not be eligible to restore the policy when it runs out. Some plans offer assured re-insurability (without proof of insurability), however such functions come at a greater expense. There are a number of sorts of term life insurance policy.

Generally, a lot of companies use terms varying from 10 to three decades, although a couple of offer 35- and 40-year terms. Level-premium insurance (joint term life insurance) has a fixed monthly payment for the life of the policy. The majority of term life insurance policy has a degree premium, and it's the type we've been referring to in a lot of this write-up.

Wisconsin Term Life Insurance

Term life insurance is eye-catching to young individuals with children. Moms and dads can get significant protection for a low expense, and if the insured dies while the plan holds, the household can depend on the fatality advantage to change lost earnings. These plans are also fit for individuals with growing households.

The right option for you will certainly rely on your needs. Here are some things to take into consideration. Term life policies are optimal for people who want considerable coverage at a reduced cost. People who have entire life insurance policy pay a lot more in premiums for less insurance coverage yet have the protection of knowing they are secured for life.

The conversion cyclist ought to enable you to transform to any permanent plan the insurance policy business offers without limitations - term life insurance with critical illness rider. The key functions of the rider are keeping the original wellness ranking of the term policy upon conversion (also if you later have health concerns or end up being uninsurable) and deciding when and just how much of the insurance coverage to transform

Certainly, general costs will certainly increase substantially given that entire life insurance policy is a lot more pricey than term life insurance policy. The advantage is the assured authorization without a clinical exam. Medical problems that create during the term life duration can not cause costs to be increased. The business may need limited or complete underwriting if you desire to include added cyclists to the brand-new plan, such as a long-term treatment motorcyclist.

Whole life insurance comes with substantially greater month-to-month premiums. It is indicated to supply protection for as long as you live.

When A Ten Year Renewable Term Life Insurance Policy Issued At Age 45

It depends on their age. Insurance provider established a maximum age limitation for term life insurance policy plans. This is generally 80 to 90 years old but may be greater or lower relying on the business. The premium also rises with age, so an individual aged 60 or 70 will pay considerably greater than somebody years more youthful.

Term life is rather similar to cars and truck insurance policy. It's statistically unlikely that you'll require it, and the costs are cash away if you don't. Yet if the most awful occurs, your family members will receive the benefits.

This plan design is for the consumer that requires life insurance coverage however would love to have the capacity to pick just how their cash value is spent. Variable policies are underwritten by National Life and distributed by Equity Services, Inc., Registered Broker/Dealer Affiliate of National Life Insurance Policy Business, One National Life Drive, Montpelier, Vermont 05604.

For J.D. Power 2024 honor info, visit Long-term life insurance policy creates cash money value that can be borrowed. Policy fundings build up rate of interest and unpaid plan car loans and passion will minimize the death benefit and money value of the policy. The amount of money worth readily available will normally depend upon the sort of irreversible plan acquired, the amount of insurance coverage acquired, the size of time the plan has been in force and any exceptional plan lendings.

A Long Term Care Rider In A Life Insurance Policy Pays A Daily Benefit

Disclosures This is a general summary of protection. A full declaration of protection is located only in the plan. For even more details on insurance coverage, costs, limitations, and renewability, or to obtain coverage, contact your local State Farm representative. Insurance coverage plans and/or connected riders and functions may not be readily available in all states, and policy terms and problems may differ by state.

The primary differences between the various sorts of term life plans on the market have to do with the size of the term and the insurance coverage amount they offer.Level term life insurance policy comes with both level costs and a level survivor benefit, which means they stay the same throughout the duration of the plan.

, additionally understood as an incremental term life insurance coverage strategy, is a policy that comes with a death benefit that boosts over time. Typical life insurance policy term lengths Term life insurance is inexpensive.

The primary distinctions in between term life and entire life are: The length of your coverage: Term life lasts for a collection duration of time and then runs out. Ordinary month-to-month entire life insurance price is computed for non-smokers in a Preferred health classification, getting an entire life insurance coverage policy paid up at age 100 offered by Policygenius from MassMutual. Aflac provides numerous lasting life insurance plans, including entire life insurance, final expense insurance policy, and term life insurance.

Latest Posts

Free Burial Insurance For Seniors

Single Premium Term Life Insurance

Insurance For Cremation